A net present value analysis of business schools in Massachusetts …

Higher education institutions are increasingly being assessed on their ability to generate a positive return on investment (ROI) for their graduates. A variety of stakeholders use the ROI and similar metrics in the college decision-making process. Students, parents, policymakers, education institutions, and rating agencies all use this information as a way to objectively rate colleges and their respective economic returns. With the increased interest and emphasis on rating related metric criteria, a single standardized rating criterion is difficult to obtain. College decision-making should employ a variety of resources unique to each student and family.

Higher education institutions are increasingly being assessed on their ability to generate a positive return on investment (ROI) for their graduates. A variety of stakeholders use the ROI and similar metrics in the college decision-making process. Students, parents, policymakers, education institutions, and rating agencies all use this information as a way to objectively rate colleges and their respective economic returns. With the increased interest and emphasis on rating related metric criteria, a single standardized rating criterion is difficult to obtain. College decision-making should employ a variety of resources unique to each student and family.

A helpful outcome-related metric is found by calculating the net present value (NPV) based on the costs and benefits of a college degree from a particular institution. Using a 10-year NPV is an important ROI calculation considering that a majority of graduates face important financial challenges within the first decade after graduation. These challenges include paying off student loans, purchasing a first home and starting a family.

Literature review

Numerous studies have addressed the growing need to quantify the ROI of colleges and universities. A leading resource is the U.S. Department of Education’s interactive College Scorecard. The Scorecard provides students and families with useful data to make more informed decisions on higher education institutions. The launch of the College Scorecard in 2013 illustrates President Obama’s commitment to provide consumers with information about college costs and value in an easy-to-read format. College is now the second-largest financial expenditure for many families, surpassed only by purchasing a home, according to Money magazine; so it isn’t surprising that taking an in-depth look at the costs and payoffs of a particular college is of paramount importance. In 2014, Kathryn B. Vasel, writing for Fox Business, made a similar statement that, aside from buying a home, college tuition is the biggest expense most people face, yet while most buyers know the total cost involved in buying a home and can plan accordingly, consumers rarely know the final price tag of a college education.

College Measures developed a tool entitled Economic Success Metrics (EMS), whose purpose is to help state agencies make information about the earnings of graduates from their higher education programs publicly accessible. These data show that the degree a student earns, and where they earn it, matters. Despite the importance placed on objectively, quantitatively derived metrics, there are several challenges in this one-size fits all methodology. Economist Jonathan Rothwell asserted in 2015 that no ranking system is perfect and there are many limitations and caveats of any such system. Value-added measures, however, can help fill information voids and be useful strategy tools focused on improving college quality and identifying schools that are contributing the most to student economic advancement.

Methodology and results

This study researched four- year undergraduate business schools in the Commonwealth of Massachusetts using the federal government’s College Scorecard. Based on the two fundamental drivers of cost and benefit, each institution’s ROI was calculated using a 10-year NPV.

The 10-year NPV calculation was derived by using the following four steps:

- Step 1: Cost. The average annual cost, from the College Scorecard represents the average annual net price (cost) for federal financial aid recipients, after aid from the school, state, or federal government. For public higher education institutions, this is the average cost for in-state students only. The average annual net cost was multiplied by a fixed amount over four years. A fixed cost, without adjusting for tuition increases, was used in this study. The rationale is based on the fact that as college tuition prices continually outpace inflation and student loan levels reach record highs, more colleges and universities are offering fixed-rate tuition plans, according to Vasel.

- Step 2: Benefit. Salary after attending, also from the College Scorecard, represents the median earnings of former students who received federal financial aid, at 10 years after entering the school. The 10-year amount was discounted every year based on an average interest rate of 3%. The 3% was estimated based on cost-of-living adjustment data from the Social Security Administration’s Average Wage Index. The values for years one through ten were summated to arrive at a 10-year present value (PV).

- Step 3: Calculate the 10-year NPV. The 10-year NPV is found by subtracting step one (cost) from step two (benefit).

- Step 4: Institutional 10-year NPV Ranking. The institutions were ranked from highest to lowest based on their 10-year NPVs.

This study was delimited based on the following College Scorecard search criteria:

- Degree = 4-year (bachelor’s)

- Control = Public and Private (nonprofit)

- Size = Any

- Program = Business, Management, Marketing, & Related Support Services

- Location = Massachusetts

- Excluded = For-profit controlled institutions and institutions with incomplete data available

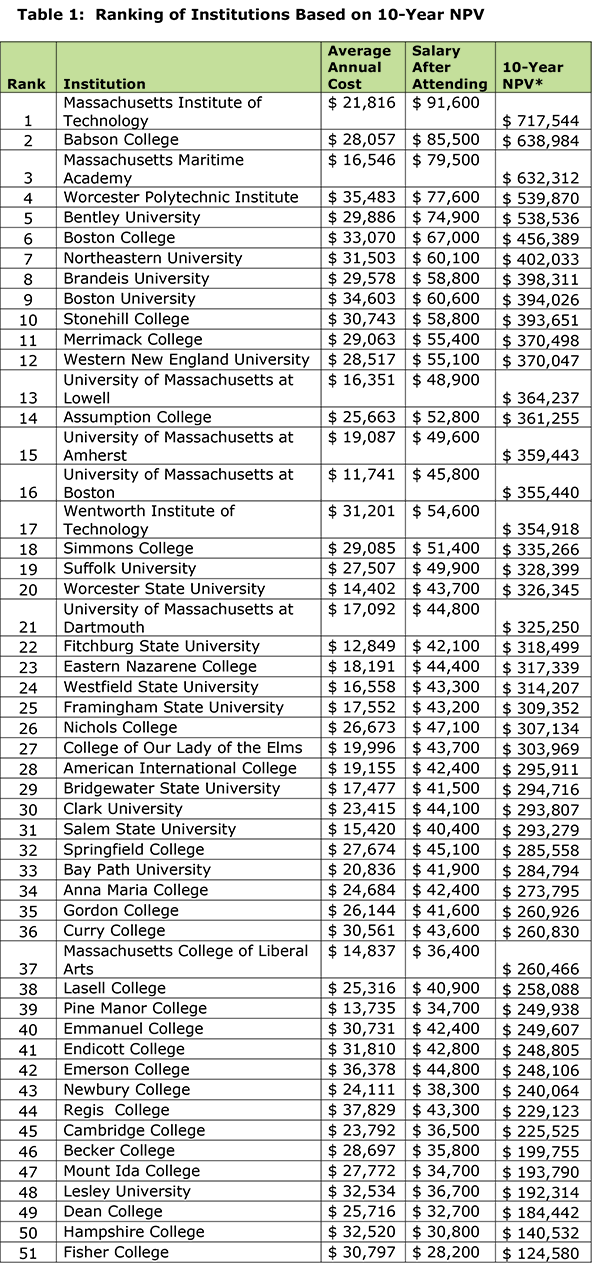

Based on these additional parameters, 51 institutions were included in the study. The institutions were then ranked from highest to lowest based on their respective NPVs. As Table 1 illustrates, Massachusetts Institute of Technology has the highest 10-year NPV at $717,544, whereas Fisher College has the lowest 10-year NPV at $124,580. There are limitations when ranking institutions based on their economic returns. For example, significant variation exists from student to student and college to college in terms of the sources and amounts of financial aid, which can make predicting and tracking what students pay difficult, as NEBHE reported in a 2016 Fast Facts on tuition charges.

* The 10-year NPV was calculated for each institution using the College Scorecard’s data on average annual cost and salary after attending. For example, the calculation for Suffolk University yields a 10-year NPV of $328,399. This value was determined based on the following assumptions: an average annual cost of $27,507 (four years, unadjusted); salary after attending (10-Year Average Salary of $49,900 discounted by 3%), and cash flows in advance (at the beginning of a period). Click here to view Table 2.

Recommendations

This study provides a framework for conducting a basic cost-benefit analysis of four-year undergraduate business schools in the Commonwealth of Massachusetts. The parameters in this study were based on specific search criteria using the federal government’s College Scorecard. The 10-year NPV is one of several useful metrics aimed at quantifying the economic returns of a college degree from a particular institution. Although there are several factors included in the college decision-making process, the data from this study and the 10-year NPV framework could be a useful and practical decision-making tool. Future research could expand to include institutions in other states, other types of institutions (e.g., two-year colleges, for-profit, etc.), and different programs of study.

Michael Dunlop is a visiting associate professor in the Department of Information Systems & Operations Management at Suffolk University’s Sawyer Business School.

[ssba]