DC Shuttle …

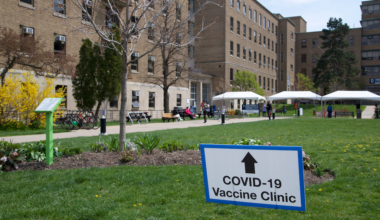

Biden Administration Releases Vaccine Mandate Guidelines. The U.S. Labor Department released a new vaccine mandate requiring that federal government employees and those of companies with greater than 100 employees get their COVID-19 vaccine or get tested weekly by Jan. 4. This fall, many colleges and universities voluntarily created a vaccine mandate for their employees and students. Some states have initiated local laws against mandates in schools. A 10-state coalition of Alaska, Arkansas, Iowa, Missouri, Montana, Nebraska, New Hampshire, North Dakota, South Dakota and Wyoming has filed a lawsuit to stop the mandate. Similarly, Texas and Florida have filled separate lawsuits. This past week, many colleges started to send out updated vaccine plans, reports Inside Higher Ed. Read more in the Wall Street Journal.

Biden Administration Releases Vaccine Mandate Guidelines. The U.S. Labor Department released a new vaccine mandate requiring that federal government employees and those of companies with greater than 100 employees get their COVID-19 vaccine or get tested weekly by Jan. 4. This fall, many colleges and universities voluntarily created a vaccine mandate for their employees and students. Some states have initiated local laws against mandates in schools. A 10-state coalition of Alaska, Arkansas, Iowa, Missouri, Montana, Nebraska, New Hampshire, North Dakota, South Dakota and Wyoming has filed a lawsuit to stop the mandate. Similarly, Texas and Florida have filled separate lawsuits. This past week, many colleges started to send out updated vaccine plans, reports Inside Higher Ed. Read more in the Wall Street Journal.

Hearing on the Community College Pipeline to Small Business. The House Subcommittee for Innovation, Entrepreneurship and Workforce Development held a hearing to address the Community College to Small Business Pipeline. The committee discussed the importance of providing a place where workers can get specialized training in the areas needed to provide services to small businesses. According to the National Federation of Independent Business (NFIB), 51% of small businesses have unfilled job openings, and in September, over 67% of businesses were attempting to hire workers. NFIB reports that 92% looking to hire employees have struggled to find candidates who are qualified to fill the vacancies. Many members of the committee agreed that community colleges could be the solution to the talent gap that small businesses are currently experiencing. Rep. Jason Crow (D-CO) stated, “These institutions are pillars of their communities, helping to provide affordable and practical educations that equip students with the skills needed to contribute to the modern economy.” Read more in Inside Higher Ed.

Pell Grant Can Accommodate Both Low- and Middle-Income Students. As an increase in the Pell Grant continues to be negotiated, a report released on Oct. 29 by the National Association of Student Financial Aid Administrators, stated that lawmakers will not have to decide between increasing the grant for low-income student or expanding the eligibility to middle-income students. The report states that by increasing the maximum award, the Pell Grant would allow for both groups to receive support. “The simplest, most predictable method of expanding Pell Grant eligibility further into the middle class is to increase the maximum Pell Grant award,” states the report. “The concomitant effect of increasing Pell Grant awards to needier students is a feature, not a bug, and reflects the intended design of the Pell Grant program.” The report also suggests changing the federal estimated family contribution (EFC) formula to expand the eligibility of the grant for more predictable and consistent impact. Read more at Inside Higher Ed.

Community Colleges Get Cybersecurity Workforce Training Support from Corporations. Microsoft announced that it would provide cybersecurity training to faculty at 150 community colleges around the country and financially support 25,000 students studying cybersecurity. Mastercard and AT&T have also created similar programs by partnering with community colleges to create greater accessibility to on-the-job training and updated resources. This push toward creating space to train individuals in specific industries is expected to play a major role within the talent gap that the cybersecurity industry is currently facing. Read more at Inside Higher Ed.

Senators Ask Department of Education to Implement Borrower Relief. The U.S. Department of Education started negotiating the rulemaking process to increase the relief for federal student loan borrowers. Senate Democrats wrote a letter to the Education Department, asking for additional protections for borrowers and student debt relief. “Our requests for student loan discharge programs and repayment plans will help protect students and support struggling student loan borrowers,” the letter states. “For all applicable programs where, additional relief is proposed for students and borrowers relative to current regulations, we strongly encourage the Department to pursue early implementation as provided by the HEA.” The department will continue to negotiate and work to create the framework for borrower defenses and repayment. Read more in this press release from the National Association of Student Financial Aid Administrators.

We publish the DC Shuttle each week Congress is in session featuring higher ed news from Washington collected by the New England Council, of which NEBHE is a member. This edition is drawn from the Higher Education Update in the Council’s Weekly Washington Report of Nov. 8, 2021. For more information, please visit: www.newenglandcouncil.com.

[ssba]