Liability of higher education institutions (HEIs) for off-campus housing risks is tricky, focusing on the institution’s role in off-campus housing arrangements.

If an HEI “assumes a duty” to its students who rely on that duty, it must fulfill the duty with due care. This general rule applies to off-campus safety: For example, if the college offered a limited shuttle bus service to or from off-campus events where it was aware of drinking, it can be liable for injuries to its student struck off campus by a car driven by an intoxicated student returning from an off-campus party. By offering the shuttle service, the HEI assumed duties to students for safety while traveling between the campus and the parties.

In the off-campus housing context, the “assumed duty” theory was determinative in a 2006 Delaware Supreme Court case. A student was assaulted by the boyfriend of another student in the parking lot of off-campus housing. The housing was “offered” by the defendant university to the plaintiff who did not get into a residence. The case went forward on negligence and detrimental reliance claims, because the university “assumed” the duty to exercise reasonable care when it undertook to provide off-campus housing.

Likewise, in 2014, a New Jersey case involved a student injured by a broken window in off-campus housing that the defendant college “arranged.” The plaintiff relied on the duty of care owed by the HEI with respect to the off-campus housing it “arranged.” Therefore, it had a duty to warn the student of the defective window in the off-campus housing unit.

Where a court may “extend” a duty

Courts seem willing to “extend” duties to an HEI, related to off-campus housing, even where the institution has not “assumed” a duty.

In Massachusetts, a landlord near Boston College complained of slander and tortious interference by BC arising from alleged statements by BC to students. The court observed BC could have a duty regarding safety to a student living off campus, because it acted like it had a duty: 1) the college had an off-campus housing office (OCHO); 2) it had a Community Assistance Patrol between students and surrounding communities; 3) BC police responded to off-campus housing disturbances involving BC students; 4) the BC student handbook referred to students’ “responsible citizenship … in local neighborhoods.”

A 2014 New Jersey case involved the liability of a private school for the violation of fire codes in off-campus housing. The school spun-off its dorms into a separate entity that the court concluded was little more than a legal fiction, and it found the school liable for the violations. The court suggested that a school may be responsible for statutory violations in off-campus housing, where there is a “mandate to liberally construe an Act to achieve the goal of fire safety.” A school may be liable for fire code violations off campus: 1) where there is some affiliation or relationship between the landlord and the school and 2) due to the nature of violated laws—i.e. fire/safety violations.

Risk management concerns

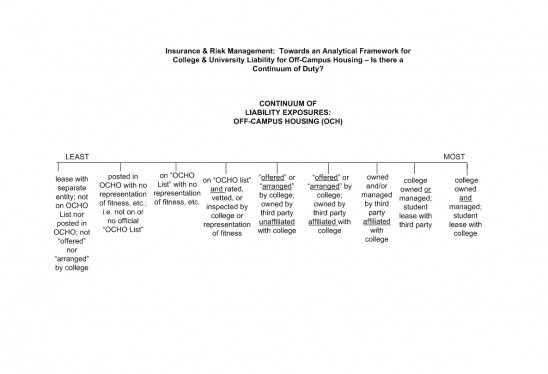

These cases demonstrate a continuum or spectrum of liability exposures for off-campus housing (Fig. 1). Risk management strategies for the liability spectrum, include:

- Language where the student waives any legal claims that they may have against the HEI arising out of off-campus housing issues, assumption of risk or limitation of liability to gross negligence in written information provided to students by an OCHO;

- Remove properties on OCHO list after written complaints—with or without investigation of complaints by the OCHO or other office of the HEI to determine whether the complaints are valid;

- Allow students to rate off-campus housing and landlords in OCHO database;

- Where a college is “arranging” or “offering” off-campus housing pursuant to a written agreement with a landlord, include indemnification, limitation of liability to gross negligence language in the contract, and “Additional Insured” status on landlord’s liability policies;

- Educate/empower students on basic landlord-tenant rights and code violations, including fire safety.

Regarding insurance, if a college or university has potential liability for off-campus housing (“assumed duty,” “offered” or “arranged”):

- Liability policies should contemplate losses taking place at those locations;

- Liability policies should respond to negligence claims, subject to exclusions, terms and conditions; whereas a breach of contract claim or a claim arising out of fire-code, housing-code, or building-code violation would likely not be covered by a liability insurance policy.

- If a school has reason to know of pre-existing hazardous conditions in off-campus housing, coverage could be barred.

- If the claim is related to a prior claim or act, there may be no coverage at all, depending on whether the insured knew of the prior matter or provided notice to the insurer.

Fig. 1

A Continuum of Liability Exposures for Off-campus Housing

For an HEI that owns or manages off-campus housing, these same concerns apply to liability policies. Plus, those properties are susceptible to “increase in hazard” theories, which could limit property coverage. (Generally, “increase in hazard” means that where there is an increase in hazard to insured property in the knowledge or control of the insured, insurance coverage will be suspended. If a loss occurs while that coverage is suspended, an insurance claim may be denied. If the hazard is cured, a loss after the reinstatement is covered. An increase in hazard will generally not be found if there has been merely a casual or temporary change in character of the premises. An insured’s negligence is not an increase in the hazard, unless it results in a change to the property, use, or occupancy.) Where there is an increase in hazard to insured property, which effects the safety of property–like increase in occupancy in the knowledge or control of the insured, coverage will be jeopardized.

Understanding where an HEI falls on the spectrum of liability exposures is essential to a risk-management strategy.

Mary-Pat Cormier is a partner in the Massachusetts law firm Bowditch & Dewey.

Related Posts:

Engines of Growth (Winter 2005 Journal:

Colleges Grappling with Emotionally Troubled Students (Summer 2004 Journal)

Colleges and Communities (Winter 2001 Journal)

[ssba]