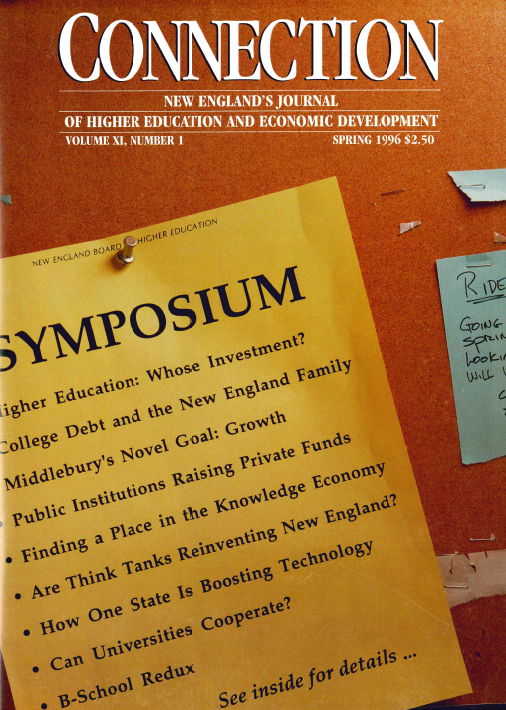

Click the cover image to view and download this issue in PDF format.

Spring 1996

For more information, contact:

John O. Harney, Executive Editor, The New England Journal of Higher Education

617.533.9501

jharney [at] nebhe [dot] org

March 29, 1996

BOSTON — Responsibility for financing higher education in New England is steadily shifting to students and families, according to a series of articles to be published next week in Connection: New England’s Journal of Higher Education and Economic Development.

Connection is the journal of the New England Board of Higher Education (NEBHE) — and America’s only regional journal linking higher education and economic development issues.

Articles in the upcoming Spring 1996 issue explain how rising tuition, shrinking student aid and lagging government support of higher education have combined to bury some students in loan debt, while discouraging others from earning college degrees.

Moreover, academia’s argument that higher education offers enormous benefits to individuals in terms of good jobs and increased lifetime earnings has been perverted, according to Connection Editor John O. Harney.

“If a college education offers individuals such a remarkable return on investment, the reasoning goes, then it should be up to individuals to pay for it,” writes Harney. “A growing body of data shows that one result of that logic has been exploding student loan debt. New England students borrowed about $1.8 billion in 1994 alone. To what extent students and families have simply been scared off by the price of a college education is harder to quantify.”

National data show student loan debt for undergraduates at four-year private institutions rose by a modest 2 percent from 1990 to 1993, while debt among undergraduates at four-year public colleges shot up 13 percent. Connection links that disparity in New England to dwindling state support of public higher education and rising tuition at public campuses across the region during the first half of the 1990s.

Connection also notes possible innovations in paying for higher education. For example, one proposal would give businesses tax incentives to include student loan repayment among fringe benefits offered to employees; another would tap America’s vast pension assets to pay for college education.

Still, the Republican-controlled Congress has proposed gutting a variety of grant and fellowship programs, while paring federal loan programs and reducing federal spending on civilian research and development by one-third over the next seven years.

NEBHE President John C. Hoy writes that the current assault on higher education and research in Washington “is another sign that New England as a region is losing its power.”

“Already, defense cuts have delivered a disproportionately heavy blow to New England,” writes Hoy. “Now, with Congress targeting R&D, Medicare, environmental programs and education and training, New England is once again uniquely positioned to take it on the chin.”

The new issue of Connection features vital data on: state support of higher education, funding of state grant programs, tuition and fees, student loan debt and fundraising by colleges and universities.

A summary of Spring 1996 Connection articles follows:

Higher Education: Whose Investment? • John O. Harney, editor of Connection, examines the dilemmas facing families, colleges and governments in the current higher education financing environment. Lagging government investment in higher education creates a vicious circle, writes Harney. “Public colleges and universities raise their tuition and mandatory fees to make up for flat or declining state support of operating expenses. Flat or declining grant programs leave students and their families with fewer resources to cover rising costs. Increased student financial need drives colleges to pump up institutional aid funds, which in turn, adds pressure to raise tuition — and more pressure for families to go into debt.”

College Debt and the New England Family • Jamie P. Merisotis, president of the Institute for Higher Education Policy in Washington, D.C., and Thomas D. Parker, president of Boston Systems Resources, Inc., a subsidiary of The Education Resources Institute, trace an explosion in student debt. Since 1990, U.S. college students have borrowed as much as the amount borrowed in the 1960s, ’70s and ’80s combined. At current rates of increase, student borrowing could approach $50 billion by the year 2000.

Middlebury Novel Goal: Growth • Middlebury College President John M. McCardell, Jr., explains why his college is pursuing a growth agenda in an age of downsizing — and doing it while keeping a lid on student fees!

Support Your Local College: Public Institutions Raising Private Funds • New England’s public colleges and universities garnered just $77 million of the $1.2 billion in private gifts made to all New England colleges and universities in academic year 1993-94. Alan R. Earls, former editor of Industry magazine, traces the public institutions’ lackluster performance to issues of alumni loyalty and even an unspoken agreement with the independents to stay out of private fundraising. Now, New England’s publics are revving up their fundraising operations.

Finding a Place for Young People in the Knowledge Economy • New England’s job market is not “dumbing down,” but “skilling up,” writes Massachusetts Undersecretary of Economic Affairs David B. Keto. Noting that nearly two-thirds of all Massachusetts jobs in 2010 will require some postsecondary education, Keto says increasing demand for more educated workers, along with growth in the number of young people over the next 15 years, will force big changes on the region’s colleges and universities.

Policy Think Tanks: Reinventing New England? • Charles D. Chieppo, director of policy development at the Pioneer Institute for Public Policy Research in Boston, observes the growth of independent and campus-affiliated research institutes in New England over the past 10 years. Chieppo explains that these “think tanks” aren’t the monastic centers of scholarship the term implies.

A Technology Underachiever Boosts Its Commitment to Science • Robert M. Kidd, president of the Maine Science and Technology Foundation, candidly discusses Maine’s historical underinvestment in science and technology, and new ambitious plans to encourage technology development in the state.

Can Universities Cooperate • Melvin Bernstein, vice president for arts, sciences and technology at Tufts University, considers new ways for New England campuses to cooperate in delivering quality educational offerings. “Administrators and faculty worry that cooperative activities will put hard-won or hoped-for attributes in jeopardy, putting at risk an institution’s real or imagined competitive advantages,” Bernstein concedes. But the benefits of cooperation outweigh the risks.

Feedback: Educating Managers • Leaders of New England management education react to the Summer/Fall issue of Connection on the changing shape of the region’s business schools. Robert E. Holmes, the Murata Dean at Babson College, predicts traditional business schools will face increasing competition from AT&T University, Motorola University, the Big 6 accounting firms and other business entities. William R. Dill, interim president of Anna Maria College and former president of Babson, explains why lesser-known private colleges like Anna Maria and state colleges are as important as their more famous B-school neighbors in preparing New England managers.

[ssba]