The New England economy continues to outperform the national economy. That is the good news. But both the region’s and nation’s economies continue to have low and staggered growth. The slow recovery from the 2008-09 recession is largely due to factors outside New England influence, including the European debt crisis, volatile energy markets and continued decline in the national housing market.

The forecast is for the regional economy to continue to grow slowly through the first half of 2011 and then pick up some modest strength, according to the Spring 2011 Outlook from the New England Economic Partnership (NEEP). Just as in the second quarter of 2010, the region experienced a dip in growth in the first quarter of 2011. The region is expected to pick up in growth in the last half of 2011, increasing in growth in overall economic from 1.7% in the first quarter of 2011 to 2.6% in the second quarter of 2011 and with above 3% growth in the third and fourth quarters of 2011.

New England continues to slowly recover the jobs lost during the recent recession. But total employment in the region is not expected to reach pre-recession (first quarter 2008) levels until early 2014. This is about the same time as the expected employment recovery in the nation. With slow labor force and population growth, the regional unemployment rate is expected to remain below the national average, but above 8% until mid-2012.

Median housing prices are not expected to start rising for another 12 to 18 months. The continued decline in housing prices affects consumer confidence and spending and has delayed the economic recovery.

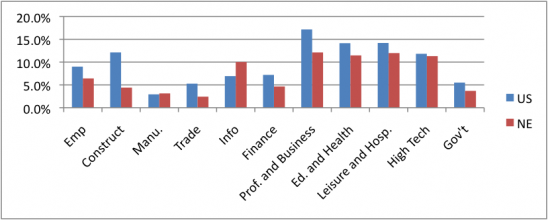

All major sectors of the regional economy were affected by the recession and experienced some decline in employment with the exception of health services. The leisure and hospitality industry in the region was the first to recover its employment loss during the recession and is expected to be followed by professional and business services and high technology. The other major so-called “supersectors” of the economy—manufacturing, trade, construction and finance—are not expected to recover the employment they lost until after 2014.

Looking at percent change from employment troughs in 2009 and 2010 to the end of the forecast period (the fourth quarter of 2014), the strongest sector of the regional economy is expected to be professional and business services, increasing by over 12%, by leisure and hospitality, also growing by 12%, and high technology and education and health services, rising by over 11%. (See Fig. 1.)

Finance, trade and manufacturing industries are expected to have weaker recoveries from their employment troughs. Government employment is expected to be adversely affected by fiscal pressures at the federal, state and local levels and decline through the middle of 2012 and then increase at a low rate of growth to the end of the forecast period.

Figure 1: Percent Changes in Sector Employment, Trough to 2014 Q4, U.S. and New England

Across the Region

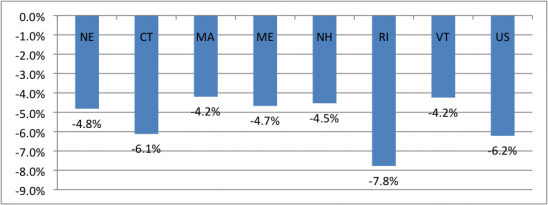

Economic performance will continue to vary significantly across the region. New Hampshire is expected to continue to have the strongest employment growth in the region. Connecticut is expected to have the weakest employment growth in the region and Rhode Island the highest unemployment rate.Massachusetts, Vermont and New Hampshire during the recession had the lowest percent declines in employment of all the states in the region at 4.5%, 4.2% and 4.2% respectively. (See Fig. 2.)Figure 2: Percent Changes in Total Employment, Peak to Trough: U.S. and Six New England States

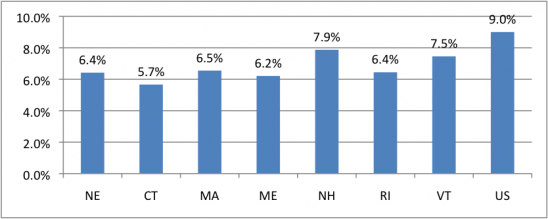

In terms of forecasted recoveries from troughs to the fourth quarter of 2014, Vermont and New Hampshire are expected to have the highest growth in total employment at 7.5% and 7.9%, respectively. (See Fig. 3.) Of these forecasted rates, no New England state is expected to grow above the forecasted U.S. average of 9%. Rhode Island is expected to grow at the regional average and at a similar rate as Massachusetts, due not as much to a strong recovery in the Ocean State, but mainly because of the state’s more pronounced decline during the recession. The remaining states in the region, Connecticut and Maine, are expected to experience growth in employment from their troughs to the end of the forecast period of 5.7% and 6.2% respectively.Figure 3: Percent Change in Total Employment, Trough to 2014, Q4: U.S. and Six New England States

New England in Slow Recovery Significant uncertainty and downside risk potential in the global and national economies could have significant negative impact on the New England economy. This includes the expanding European debt crisis, continued unresolved housing issues and government at all levels under significant financial stress.The recovery from the recession of 2008-09 in the New England states is expected to continue to be slow and precarious. The region’s economy will not improve significantly until the national economy improves.____________________________________________________________________________ Ross Gittell is the James R. Carter Professor at the University of New Hampshire’s Whittemore School of Business and Economics.

[ssba]